Yeah, it gets a lot of buzz on the boob tube, and you saw the meme of the guy who gave his girl an egg in a fancy ring box, with the heading, “He went to Kroger’s!”

But with everything else going on in the world, you just can’t see inflation being a real problem, considering you still earn a lot and are still able to save a lot. Right?

Well . . . unfortunately, I have some bad

news for you. Are you ready?

The US Government has been spending way more than they take in, for many years now. Could you imagine doing that yourself? Of course not. Not year after year after year! But it’s different when it’s the government, right?

Well, yes and no. The government can print more (and more and more) money to pay expenses which exceed revenues. But just like you, they need to reverse course in other years and pay down the debt.

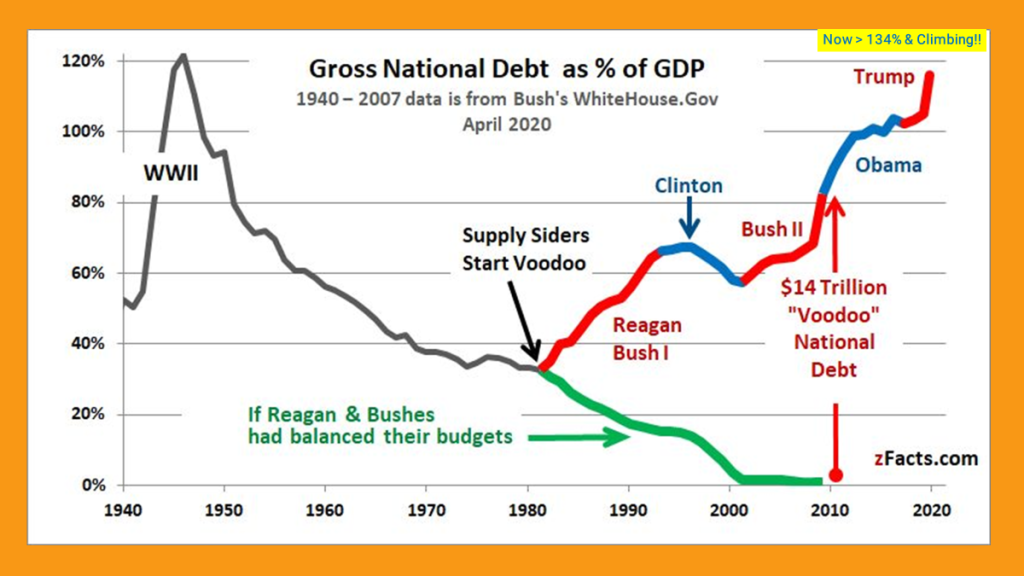

We did that, as a nation, after World War II, reducing the debt – as a percentage of Gross Domestic Product, which is how it’s measured – from 120% to around 35%. Most economists will tell you some debt is good and necessary, but ideally, the national debt should be between 40% and 70% of GDP. Today, it stands at 130% of GDP! We owe other people and countries over $31.5 Trillion. That means we need to start taking in more than we spend until that dollar amount drops to around $12T to $20T.

How do we do that? Well, Congress could reduce entitlements like Medicare and Social Security. They could tell those Baby Boomers (~10,000 of whom turn 65 every single day), “Even though you contributed to the Social Security system over your 40 year working career, AND paid taxes on those contributions you gave us, and you now pay taxes on up to 85% of the benefits – which you are 100% entitled to – unfortunately, we need to dramatically cut those benefits to pay down our credit cards, if you will.” “Oh, and don’t forget to vote for me next election!”

Or, like we did between 1945 and 1985, we can dramatically raise income tax rates. Fun Fact: If you take your current income, and adjust it for inflation, in ANY year from 1945 to 1985, your income taxes would be anywhere from 130% to 200% of what you are paying right now. It’s a bit confusing, but trust me – that’s terrible, awful, really bad news! We’ve already been there, done that BEFORE!

PLEASE UNDERSTAND. Too much money in circulation leads to inflation. Inflation leads to higher interest rates. We have both of those right now. When those $31.5T in Treasury Bills, Bonds and Notes come due, and there’s insufficient tax revenues to retire them, we have to print new ones to replace them – AT EVEN HIGHER INTEREST RATES!!! Inflation really should concern you!!

DIVORCE the IRS and retire TAX-FREE (or close to it!) at taxfreetutors.com.